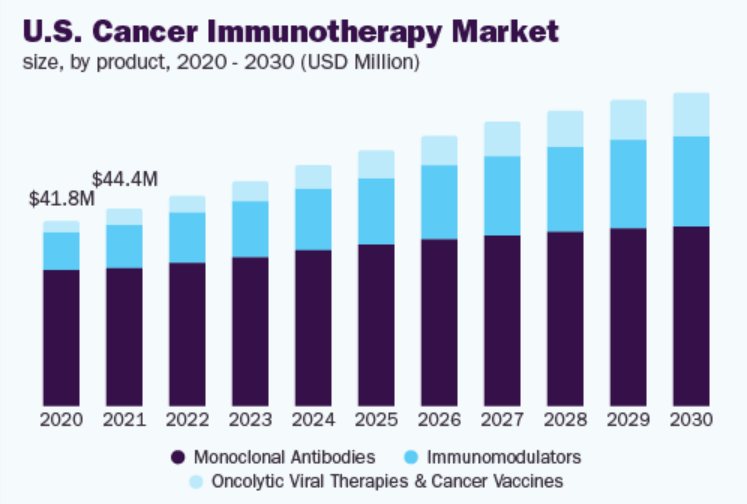

The global cancer immunotherapy market was valued at USD 104.96 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2022 to 2030. Increasing prevalence of oncology across the globe coupled with a surge in R&D efforts for the development of novel oncology therapeutics are the major driving factors for the market. Moreover, the presence of various organizations that support immunotherapy research is also expected to fuel market growth. The most common type of malignancies affecting the U.S. population is breast, prostate, lung, and colorectal. In addition, according to the Cancer Council, Australia reported 150,000 new cancer cases with 50,000 deaths in 2020. Thus, the surge in prevalence of malignant tumor cases is anticipated to accelerate market expansion in the coming years.

The presence of various government and non-government organizations that create awareness and promote research is augmenting market expansion. For instance, Cancer Research Institute funded more than 120 clinical trials and invested around USD 474 million in research. Moreover, the Society for Immunotherapy of Cancer(SITC) is engaged in improving patient outcomes by advancing the science and application of oncology immunotherapy. These organizations are working with scientists and researchers to discover novel treatment regimens of immune therapy.

Cancer Immunotherapy Market Size & Market Analysis

Furthermore, increasing funding for the development of novel treatments is expected to boost R&D activities to develop cancer immunotherapy. For instance, in June 2022, a group of Stanford scientists received funding of USD 13 million from Cancer Grand Challenges, a funding initiative by Cancer Research UK and the U.S. National Cancer Institute. This funding is awarded for the development of next-generation immunotherapies, the study of extrachromosomal DNA, and the investigation of early-stage malignancies.

Increasing approval of novel immunotherapies is anticipated to propel the market growth over the forecast period. During 2020-2022, the U.S. FDA has approved various anti-PD-1/L1 antibodies such as nivolumab, atezolizumab, avelumab, dostarlimab, and others for the treatment of NSCLC, renal cell carcinoma, melanoma, breast, prostate malignancies, and others. The higher approvals of immunotherapeutic agents have propelled the market growth.

Various Strategic initiatives undertaken by leading players are also expected to facilitate the market demand. For instance, in August 2022, BioNTech SE and Genmab A/S expanded their strategic collaboration for the development and launch of new immune therapies for the treatment of various cancer forms. Moreover, in March 2022, Merck & Co., Inc announced the approval of KEYTRUDA from the U.S. FDA. KEYTRUDA is an anti-PD-1 therapy for the treatment of advanced endometrial carcinoma.

However, side effects associated with immunotherapy are likely to hamper the prescription rate for cancer treatment. The available therapies are associated with several adverse effects, such as pain, insomnia, fatigue, nausea, and gastrointestinal conditions. These adverse effects impact the overall quality of life of patients and the management of these adverse effects incurs extra costs. In addition, prolonged consumption of immunotherapeutic drugs may cause severe damage to the organs and increase the incidence of organ failure cases.

The presence of various government and non-government organizations that create awareness and promote research is augmenting market expansion. For instance, Cancer Research Institute funded more than 120 clinical trials and invested around USD 474 million in research. Moreover, the Society for Immunotherapy of Cancer(SITC) is engaged in improving patient outcomes by advancing the science and application of oncology immunotherapy. These organizations are working with scientists and researchers to discover novel treatment regimens of immune therapy.

Cancer Immunotherapy Market Size & Market Analysis

Furthermore, increasing funding for the development of novel treatments is expected to boost R&D activities to develop cancer immunotherapy. For instance, in June 2022, a group of Stanford scientists received funding of USD 13 million from Cancer Grand Challenges, a funding initiative by Cancer Research UK and the U.S. National Cancer Institute. This funding is awarded for the development of next-generation immunotherapies, the study of extrachromosomal DNA, and the investigation of early-stage malignancies.

Increasing approval of novel immunotherapies is anticipated to propel the market growth over the forecast period. During 2020-2022, the U.S. FDA has approved various anti-PD-1/L1 antibodies such as nivolumab, atezolizumab, avelumab, dostarlimab, and others for the treatment of NSCLC, renal cell carcinoma, melanoma, breast, prostate malignancies, and others. The higher approvals of immunotherapeutic agents have propelled the market growth.

Various Strategic initiatives undertaken by leading players are also expected to facilitate the market demand. For instance, in August 2022, BioNTech SE and Genmab A/S expanded their strategic collaboration for the development and launch of new immune therapies for the treatment of various cancer forms. Moreover, in March 2022, Merck & Co., Inc announced the approval of KEYTRUDA from the U.S. FDA. KEYTRUDA is an anti-PD-1 therapy for the treatment of advanced endometrial carcinoma.

However, side effects associated with immunotherapy are likely to hamper the prescription rate for cancer treatment. The available therapies are associated with several adverse effects, such as pain, insomnia, fatigue, nausea, and gastrointestinal conditions. These adverse effects impact the overall quality of life of patients and the management of these adverse effects incurs extra costs. In addition, prolonged consumption of immunotherapeutic drugs may cause severe damage to the organs and increase the incidence of organ failure cases.

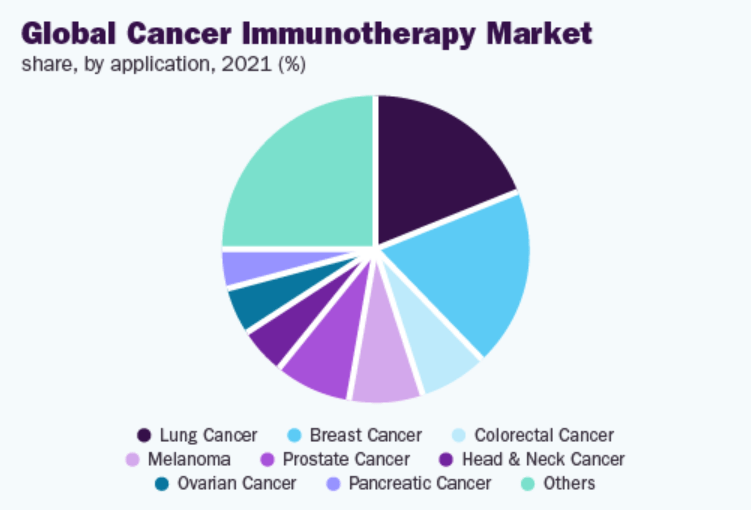

The lung cancer segment dominated the market in 2021. The rising prevalence of lung malignancies, increasing adoption of immunotherapy, increase in awareness programs, and presence of a robust pipeline of investigational candidates are some of the key factors expected to drive the segment’s growth. Furthermore, rising product approval and product launch fueling the demand forward. For instance, in October 2021, the U.S. FDA approved Tecentriq (atezolizumab) for the treatment of stage II and stage III NSCLC.

The breast cancer segment held the second largest share owing to the high prevalence of the disease, ongoing research activities, and rising investments by leading players to develop novel therapeutics for breast malignancies are expected to accelerate segment expansion. However, the prostate cancer segment is anticipated to experience the fastest growth rate over the forecast period.

Market players are adopting strategies such as new product development, merger & acquisition, and partnership to increase their market share. For instance, in February 2022, Medigene AG and BioNTech SE collaborated to develop T-cell receptor-based immunotherapies for oncology disorders. Some prominent players in the cancer immunotherapy market include:

- Pfizer Inc.

- AstraZeneca

- Merck & Co., Inc

- F. Hoffmann-La Roche Ltd

- Bristol-Myers Squibb Company

- Genentech, Inc (Roche)

- Novartis AG

- Lilly

- Johnson & Johnson Services, Inc

- Immunocore, Ltd

In 2021, North America led the overall market in terms of revenue due to the presence of a large number of leading players coupled with various Strategic initiatives undertaken by them. Moreover, the increase in disease prevalence and the presence of various government and non-government organizations that promote research activities for cancer immunotherapy, and the increasing approval of novel drugs are fueling the regional market growth. For instance, in April 2022, the U.S. FDA approved Opdivo (nivolumab) for the treatment of NSCLC in adult patients. Asia Pacific is projected to witness the fastest growth rate over the forecast period. The increase in the geriatric population, a large patient base of a targeted diseases, and improving healthcare infrastructure are some of the primary factors driving the growth. Moreover, the rising regulatory approvals of immune therapies in the region are also contributing region’s expansion. For instance, during 2020-2022, the National Medical Products Administration of China approved Pembrolizumab and Durvalumab for the treatment of esophageal cancer and SCLC.

Source : https://www.grandviewresearch.com/industry-analysis/cancer-immunotherapy-market