SynuSight Biotech, ABLi Therapeutics and XingImaging Announce Strategic Collaboration to Implement Alpha-Synuclein PET Imaging into Clinical Trials Evaluating Risvodetinib as a Disease-modifying Therapy for Parkinson’s Disease

SynuSight Biotech, ABLi Therapeutics and XingImaging Announce Strategic Collaboration to Implement Alpha-Synuclein PET Imaging into Clinical Trials Evaluating Risvodetinib as a Disease-modifying Therapy for Parkinson’s Disease

SynuSight Biotech has licensed 18F-FD4 to XingImaging and to ABLi Therapeutics to evaluate alpha-synuclein clearance from the brain in response to risvodetinib treatment

SHANGHAI and ATLANTA and NEW HAVEN, Conn., Jan. 05, 2026 (GLOBE NEWSWIRE) — SynuSight Biotech (“SynuSight”), a biotechnology company dedicated to the development of diagnostic solutions for neurodegenerative diseases and ABLi Therapeutics (“ABLi”), a biotechnology company developing disease-modifying therapeutics in Parkinson’s disease, have entered into non-exclusive clinical use license agreement that permits ABLi to utilize 18F-FD4 (“FD4”) in its trials to evaluate risvodetinib as a disease-modifying therapy for Parkinson’s disease (PD).

SynuSight pioneered the development of the alpha-synuclein aggregate-specific PET tracer FD4 to visualize alpha-synuclein pathology in human brain. As part of this licensing collaboration, SynuSight will receive an upfront payment and subsequent license-related fees from ABLi. As part of the collaboration, XingImaging will become the U.S.-based manufacturer of FD4 and marry it to the ultra-high resolution NeuroEXPLORER, a next generation dedicated brain PET imager housed at Xing’s newly established imaging facility in New Haven, CT.

ABLi will leverage the ability of FD4 to visualize alpha-synuclein pathology in the central nervous system to complement the novel blood-borne and tissue biomarkers developed by ABLi and its collaborators, establishing an integrated framework for comprehensive evaluation of the therapeutic effects of risvodetinib in PD. ABLi plans to implement FD4 in two clinical trials in 2026. The first, ABILITY-PD, plans to re-enroll the 120 participants in the Phase 2a 201 Trial completed in 4Q24 to measure the effect of risvodetinib treatment on biomarkers from brain, blood and tissue in a 12-month longitudinal biomarker study. ABILITY-PD will also collect motor, non-motor and dopamine transporter-specific functional data to evaluate how changes in biomarkers throughout the body correlate with functional outcomes in response to treatment. The second, the c-Abl inhibitor Modification of Parkinson’s Disease (CAMPD) trial, a Phase 2b/3 trial, will evaluate the efficacy of risvodetinib in a double-blind, placebo controlled trial in up to 500 participants with untreated Parkinson’s disease.

“This collaboration represents a key milestone in the global development of FD4. By integrating molecular imaging technologies with rigorously designed clinical trials and longitudinal follow-up, the partnership aims to directly interrogate the disease-modifying potential at the pathological level,” said SynuSight CEO Roger Fan.

“ABLi has been expanding its portfolio of disease-related biomarkers, with both blood-borne and tissue measures of alpha-synuclein pathology and is excited to add alpha-synuclein PET imaging to this panel to expand our understanding of the potential disease-modifying effect of risvodetinib in PD,” said Dr. Milton Werner, Chairman and Chief Executive of ABLi.

“This represents a pivotal opportunity to advance one of the most promising alpha-synuclein PET tracers in humans with the potential disease-modifying effect of risvodetinib in PD,” said Gilles Tamagnan, CEO of XingImaging.

About Risvodetinib (ABLi-148009)

Risvodetinib is a potent, selective small-molecule inhibitor of the non-receptor c-Abl kinases, designed for once-daily oral use that targets the underlying biological mechanisms driving Parkinson’s disease initiation and progression. Risvodetinib is believed to be a disease-modifying therapy that halts disease progression and reverses the functional loss arising from Parkinson’s disease inside and outside of the brain. All marketed therapeutic approaches to treat Parkinson’s help manage the symptoms of the disease, but there are currently no available treatments to slow or stop the disease’s relentless progression. Recently, risvodetinib was the first monotherapy shown to improve patient quality of life in a randomized, placebo-controlled clinical trial (NCT NCT05424276) and simultaneously reduced the underlying synuclein aggregate pathology in untreated Parkinson’s disease. Risvodetinib currently has intellectual property protection beyond 2036.

About 18F-FD4

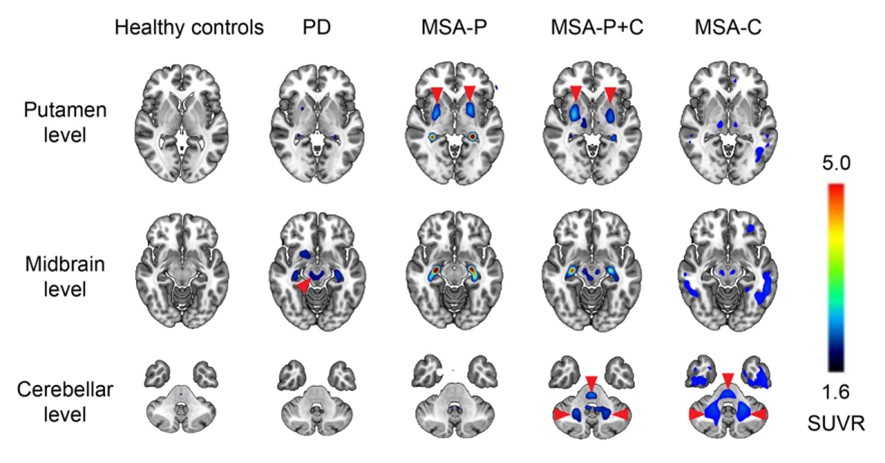

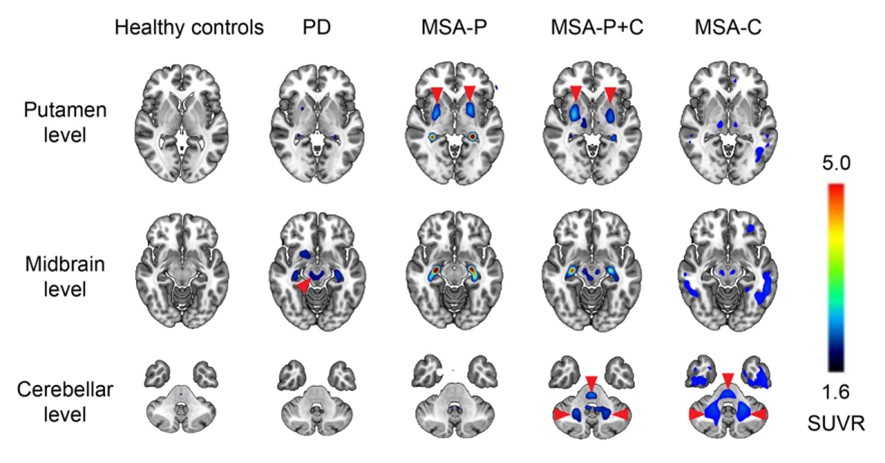

18F-FD4 is a selective, high-affinity PET tracer developed by SynuSight to image pathogenic α-synuclein in Parkinson’s disease and related α-synucleinopathies. 18F-FD4 has demonstrated efficient blood-brain barrier penetration, a clear and stable imaging window with rapid washout, low off-target binding, and favorable safety in both preclinical studies and investigator-initiated trials at Huashan Hospital. In patients with PD and MSA, 18F-FD4 has consistently produced high-contrast signals in pathology-relevant brain regions and shown robust disease-differentiation performance (see image). In 2025, 18F‑FD4 received a $3.84 million research grant from the Michael J. Fox Foundation for Parkinson’s Research (MJFF)—the world’s largest nonprofit philanthropy of PD research—to support its U.S. clinical registration and development, underscoring the strong scientific rationale and clinical potential of this novel α-synuclein PET tracer. This funding award highlights the confidence of leading international research institutions in 18F-FD4 as a next-generation imaging biomarker, and clinical development is expected to begin in both the U.S. and China in the first quarter of 2026.

About ABLi Therapeutics

ABLi Therapeutics (“ABLi”) applies innovative medicinal chemistry and a deep understanding of disease biology to develop small molecule therapeutics that target the cause of diseases that arise from activation or dysfunction of the Abelson Tyrosine Kinases (c-Abl). Leveraging its expertise in drug design, ABLi utilizes clinically validated data of kinase inhibitors to design and develop novel product candidates with enhanced penetration into the brain, greater potency and target selectivity, and improved safety to treat diseases in which Abl kinase activation or dysfunction is implicated. The Company’s primary focus is on developing therapeutics for the treatment of neurodegenerative diseases like Parkinson’s disease and the Parkinson’s-related neurodegenerative diseases Multiple System Atrophy and Dementia with Lewy Body, that are all associated with Abl kinase activation or dysfunction. For more information visit www.ablitherapeutics.com or follow us on LinkedIn.

About XingImaging

XingImaging provides services across the pre-clinical and clinical spectrum including radioligand development and manufacturing, design and implementation of Phase 1 to Phase 4 clinical trials, and customized clinical imaging site coordination and management in multi-site imaging studies. Xing’s strong emphasis is on research using investigational radiotracers with quantitative imaging outcome measures as diagnostic tools and/or for assessing disease mechanism or progression. Xing focuses on developing radioligands as tools for human research aimed at advancing clinical neuroscience and nuclear medicine to understand the causes and develop more effective treatments for neurodegenerative disorders.

About SynuSight Biotech

SynuSight Biotech is committed to pioneering transformative diagnostic solutions for neurodegenerative diseases through cutting-edge scientific expertise and innovative technology platforms, ultimately benefiting millions of patients worldwide. SynuSight specializes in studying the misfolding and pathological aggregation of proteins such as alpha-synuclein, tau, and A-beta. By integrating cutting-edge technologies like Cryo-EM electron diffraction, helical filament imaging, and In-cell NMR spectroscopy, we have built unparalleled expertise in key neurodegenerative disease targets, unlocking new possibilities for innovative therapeutic solutions development.

Contacts:

For ABLi Therapeutics

info@ablitherapeutics.com

For XingImaging

info@xingimaging.com

For SynuSight Biotech

info@synusight.com

Investor/Media

Mike Moyer

Managing Director – LifeSci Advisors

mmoyer@lifesciadvisors.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0ebb1518-1452-44f1-9637-9e9f64f66132