Amneal Reports First Quarter 2024 Financial Results

Amneal Reports First Quarter 2024 Financial Results

‒ Q1 2024 Net Revenue of $659 million; GAAP Net Loss of $92 million; Diluted Loss per Share of $0.30 ‒

‒ Adjusted EBITDA of $152 million; Adjusted Diluted EPS of $0.14 ‒

‒ Company has reached settlement in principle on a nationwide opioids settlement, payable over ten years ‒

‒ Affirming 2024 Full Year Guidance ‒

BRIDGEWATER, N.J.–(BUSINESS WIRE)–Amneal Pharmaceuticals, Inc. (Nasdaq: AMRX) (“Amneal” or the “Company”) announced its results today for the first quarter ended March 31, 2024.

“We are extremely pleased with our outstanding start to the year, as Amneal generated record levels of revenues in the first quarter. For the first time, all three segments across our diversified business produced double-digit top-line growth in the same quarter. With perpetual and rising demand for medicines and exacerbated by chronic supply shortages in the U.S. pharmaceutical industry, Amneal is part of the solution. As we become larger, we provide even more patients with access to high-quality, affordable, and essential medicines as we create value for all our stakeholders,” said Chirag and Chintu Patel, Co-Chief Executive Officers.

First Quarter 2024 Results

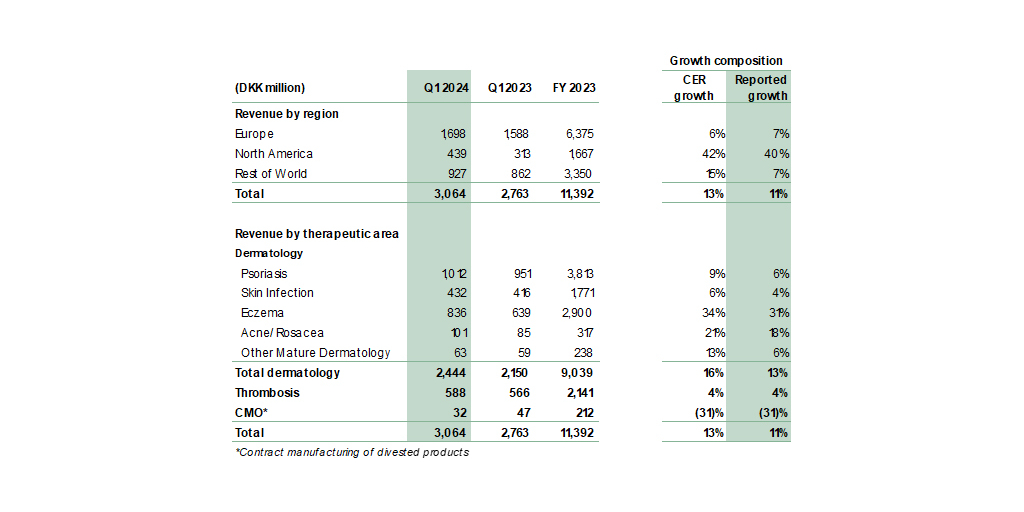

Net revenue in the first quarter of 2024 was $659 million, an increase of 18% compared to $558 million in the first quarter of 2023. Generics revenues increased 14% due to strong performance in complex generics, our oncology biosimilars and new launches. Specialty revenues increased 15% driven by promoted products in Neurology and Endocrinology. AvKARE revenues increased 33% driven by continued expansion across its channels due to new products.

Net loss attributable to Amneal Pharmaceuticals, Inc. was $92 million in the first quarter of 2024 compared to $7 million in the first quarter of 2023, and included a pre-tax charge of $94 million for settlement in principle on a nationwide opioids settlement.

Adjusted EBITDA in the first quarter of 2024 was $152 million, an increase of 31% compared to the first quarter of 2023, reflective of strong revenue performance and higher gross margins.

Diluted loss per share in the first quarter of 2024 was $0.30 compared to $0.05 for the first quarter of 2023 due to the aforementioned factors. Adjusted diluted earnings per share in the first quarter of 2024 was $0.14 compared to $0.12 for the first quarter of 2023.

The Company presents GAAP and adjusted (non-GAAP) quarterly results. Please refer to the “Non-GAAP Financial Measures” section for more information. In the tables below, GAAP to non-GAAP reconciliations are presented.

Settlement in Principle on a Nationwide Opioids Settlement

Amneal has reached a settlement in principle on the primary financial terms, with no admission of wrongdoing, for a nationwide resolution to the opioids cases that have been filed and that might have been filed against the Company by states, counties, municipalities, and Native American Tribal Nations across the United States. The settlement in principle resolves substantially all opioids litigation and is subject to the negotiation and execution of a definitive settlement agreement between the parties. The settlement would be payable over ten years. Under the settlement, the Company would agree to pay $92.5 million in cash and provide $180.0 million in naloxone nasal spray (valued at $125 per two-pack) to help treat opioid overdoses. In lieu of receiving product, the settling parties can opt to receive 25% of the product value (up to $45.0 million) in cash during the last four years of the ten-year payment term.

In the first quarter of 2024, the Company recorded a charge of $94 million in the consolidated statement of operations based on full participation in the potential settlement, which reflects the value of the cash payments and the supply of naloxone nasal spray over the ten-year period. The settlement in principle is contingent upon a sufficient number of settling parties electing to opt into the final definitive agreement. We remain committed to helping those impacted by the opioid crisis by enhancing access to naloxone nasal spray, which is an emergency treatment for opioid overdose and helps save lives.

Affirming Full Year 2024 Guidance

The Company is affirming its previously provided full year 2024 guidance.

|

Net revenue |

$2.55 billion – $2.65 billion |

|

Adjusted EBITDA (1) |

$580 million – $620 million |

|

Adjusted diluted EPS (2) |

$0.53 – $0.63 |

|

Operating cash flow (3) |

$260 million – $300 million |

|

Capital expenditures |

$60 million – $70 million |

|

(1) |

Includes 100% of Adjusted EBITDA from the AvKARE acquisition. |

|

|

(2) |

Accounts for 35% non-controlling interest in AvKARE. Assumes weighted-average diluted shares outstanding of approximately 317 million for the year ending December 31, 2024. |

|

|

(3) |

Does not contemplate one-time and non-recurring items such as legal settlements and other discrete items. |

Amneal’s 2024 estimates are based on management’s current expectations, including with respect to prescription trends, pricing levels, the timing of future product launches, the costs incurred and benefits realized of restructuring activities, and our long-term strategy. The Company’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Company cannot provide a reconciliation between non-GAAP projections and the most directly comparable measures in accordance with GAAP without unreasonable efforts because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items required for the reconciliation. The items include, but are not limited to, acquisition-related expenses, restructuring expenses and benefits, asset impairments, legal settlements, and other gains and losses. These items are uncertain, depend on various factors, and could have a material impact on GAAP reported results.

Conference Call Information

Amneal will host a conference call and live webcast at 8:30 am Eastern Time today, May 3, 2024, to discuss its results. The live webcast and presentation will be accessible through the Investor Relations section of the Company’s website at https://investors.amneal.com. To access the call through a conference line, dial (833) 470-1428 (in the U.S.) with access code 172198. A replay of the conference call will be posted shortly after the call and will be available for seven days. For a list of toll-free international numbers, visit this website: https://www.netroadshow.com/events/global-numbers?confId=52762.

About Amneal

Amneal Pharmaceuticals, Inc. (Nasdaq: AMRX), headquartered in Bridgewater, NJ, is a global pharmaceuticals company. We make healthy possible through the development, manufacturing, and distribution of a diverse portfolio of over 280 generic and specialty pharmaceuticals, primarily within the United States. In its Generics segment, the Company is expanding across a broad range of complex product categories and therapeutic areas, including injectables and biosimilars. In its Specialty segment, Amneal has a growing portfolio of branded pharmaceuticals focused primarily on central nervous system and endocrine disorders, with a pipeline focused on unmet needs. Through its AvKARE segment, the Company is a distributor of pharmaceuticals and other products for the U.S. federal government, retail, and institutional markets. For more information, please visit www.amneal.com.

Cautionary Statement on Forward-Looking Statements

Certain statements contained herein, regarding matters that are not historical facts, may be forward-looking statements (as defined in the U.S. Private Securities Litigation Reform Act of 1995). Such forward-looking statements include statements regarding management’s intentions, plans, beliefs, expectations, financial results, or forecasts for the future, including among other things: discussions of future operations; expected or estimated operating results and financial performance; and statements regarding our positioning, including our ability to drive sustainable long-term growth, and other non-historical statements. Words such as “plans,” “expects,” “will,” “anticipates,” “estimates,” and similar words, or the negatives thereof, are intended to identify estimates and forward-looking statements.

The reader is cautioned not to rely on these forward-looking statements. These forward-looking statements are based on current expectations of future events, including with respect to future market conditions, company performance and financial results, operational investments, business prospects, new strategies and growth initiatives, the competitive environment, and other events. If the underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from the expectations and projections of the Company.

Such risks and uncertainties include, but are not limited to: our ability to successfully develop, license, acquire and commercialize new products on a timely basis; the competition we face in the pharmaceutical industry from brand and generic drug product companies, and the impact of that competition on our ability to set prices; our ability to obtain exclusive marketing rights for our products; our revenues are derived from the sales of a limited number of products, a substantial portion of which are through a limited number of customers; the impact of a prolonged business interruption within our supply chain; the continuing trend of consolidation of certain customer groups; our dependence on third-party suppliers and distributors for raw materials for our products and certain finished goods; legal, regulatory and legislative efforts by our brand competitors to deter competition from our generic alternatives; our dependence on information technology systems and infrastructure and the potential for cybersecurity incidents; our ability to attract, hire and retain highly skilled personnel; risks related to federal regulation of arrangements between manufacturers of branded and generic products; our reliance on certain licenses to proprietary technologies from time to time; the significant amount of resources we expend on research and development; the risk of claims brought against us by third parties; risks related to changes in the regulatory environment, including U.S. federal and state laws related to healthcare fraud abuse and health information privacy and security and changes in such laws; changes to Food and Drug Administration product approval requirements; the impact of healthcare reform and changes in coverage and reimbursement levels by governmental authorities and other third-party payers; our dependence on third-party agreements for a portion of our product offerings; our substantial amount of indebtedness and our ability to generate sufficient cash to service our indebtedness in the future, and the impact of interest rate fluctuations on such indebtedness; our potential expansion into additional international markets subjecting us to increased regulatory, economic, social and political uncertainties; our ability to identify, make and integrate acquisitions or investments in complementary businesses and products on advantageous terms; the impact of global economic, political or other catastrophic events; our obligations under a tax receivable agreement may be significant; and the high concentration of ownership of our Class A common stock and the fact that we are controlled by the Amneal Group. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in the Company’s filings with the Securities and Exchange Commission, including under Item 1A, “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and in its subsequent reports on Forms 10-Q and 8-K. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. Forward-looking statements included herein speak only as of the date hereof and we undertake no obligation to revise or update such statements to reflect the occurrence of events or circumstances after the date hereof.

Non-GAAP Financial Measures

This release includes certain non-GAAP financial measures, including EBITDA, adjusted EBITDA, adjusted net income and adjusted diluted EPS, which are intended as supplemental measures of the Company’s performance that are not required by or presented in accordance with GAAP. Adjusted diluted EPS reflects diluted earnings per share based on adjusted net income, which is net loss adjusted to (A) exclude (i) non-cash interest, (ii) GAAP provision for income taxes, (iii) amortization, (iv) stock-based compensation, (v) acquisition, site closure expenses, and idle facility expenses, (vi) restructuring and other charges, (vii) charges related to certain legal matters, including interest, net, (viii) asset impairment charges, (ix) change in fair value of contingent consideration, (x) increase in tax receivable agreement liability, (xi) system implementation expense, (xii) other and (xiii) net income attributable to non-controlling interests not associated with Class B common stock, and (B) include non-GAAP provision for income taxes. Non-GAAP adjusted diluted EPS for the three months ended March 31, 2024 was calculated using the weighted average fully diluted shares outstanding of Class A common stock. Non-GAAP adjusted diluted EPS for the three months ended March 31, 2023 was calculated using the weighted average diluted shares outstanding of Class A common stock and assuming all shares of Class B common stock were converted to shares of Class A common stock as of January 1, 2023.

Management uses these non-GAAP measures internally to evaluate and manage the Company’s operations and to better understand its business because they facilitate a comparative assessment of the Company’s operating performance relative to its performance based on results calculated under GAAP. These non-GAAP measures also isolate the effects of some items that vary from period to period without any correlation to core operating performance and eliminate certain charges that management believes do not reflect the Company’s operations and underlying operational performance. The compensation committee of the Company’s board of directors also uses certain of these measures to evaluate management’s performance and set its compensation. The Company believes that these non-GAAP measures also provide useful information to investors regarding certain financial and business trends relating to the Company’s financial condition and operating results facilitates an evaluation of the financial performance of the Company and its operations on a consistent basis. Providing this information therefore allows investors to make independent assessments of the Company’s financial performance, results of operations and trends while viewing the information through the eyes of management.

These non-GAAP measures are subject to limitations. The non-GAAP measures presented in this release may not be comparable to similarly titled measures used by other companies because other companies may not calculate one or more in the same manner. Additionally, the non-GAAP performance measures exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements; do not reflect changes in, or cash requirements for, working capital needs; and do not reflect interest expense, or the requirements necessary to service interest or principal payments on debt. Further, our historical adjusted results are not intended to project our adjusted results of operations or financial position for any future period. To compensate for these limitations, management presents and considers these non-GAAP measures in conjunction with the Company’s GAAP results; no non-GAAP measure should be considered in isolation from or as alternatives to any measure determined in accordance with GAAP. Readers should review the reconciliations included below, and should not rely on any single financial measure to evaluate the Company’s business.

A reconciliation of each historical non-GAAP measure to the most directly comparable GAAP measure is set forth below.

Amneal Pharmaceuticals, Inc.

Consolidated Statements of Operations

(unaudited; $ in thousands, except per share amounts)

|

|

Three Months Ended March 31, |

||||||

|

|

|

2024 |

|

|

|

2023 |

|

|

Net revenue |

$ |

659,191 |

|

|

$ |

557,540 |

|

|

Cost of goods sold |

|

421,131 |

|

|

|

379,354 |

|

|

Gross profit |

|

238,060 |

|

|

|

178,186 |

|

|

Selling, general and administrative |

|

112,595 |

|

|

|

102,096 |

|

|

Research and development |

|

39,298 |

|

|

|

38,690 |

|

|

Intellectual property legal development expenses |

|

984 |

|

|

|

1,644 |

|

|

Restructuring and other charges |

|

1,470 |

|

|

|

510 |

|

|

Change in fair value of contingent consideration |

|

100 |

|

|

|

2,457 |

|

|

Charges (credit) related to legal matters, net |

|

94,359 |

|

|

|

(436 |

) |

|

Other operating income |

|

— |

|

|

|

(1,224 |

) |

|

Operating (loss) income |

|

(10,746 |

) |

|

|

34,449 |

|

|

Other (expense) income: |

|

|

|

||||

|

Interest expense, net |

|

(65,703 |

) |

|

|

(49,315 |

) |

|

Foreign exchange (loss) gain, net |

|

(1,197 |

) |

|

|

1,901 |

|

|

Increase in tax receivable agreement liability |

|

(1,948 |

) |

|

|

(826 |

) |

|

Other income, net |

|

4,072 |

|

|

|

4,365 |

|

|

Total other expense, net |

|

(64,776 |

) |

|

|

(43,875 |

) |

|

Loss before income taxes |

|

(75,522 |

) |

|

|

(9,426 |

) |

|

Provision for income taxes |

|

6,156 |

|

|

|

668 |

|

|

Net loss |

|

(81,678 |

) |

|

|

(10,094 |

) |

|

Less: Net (income) loss attributable to non-controlling interests |

|

(9,965 |

) |

|

|

3,151 |

|

|

Net loss attributable to Amneal Pharmaceuticals, Inc. |

$ |

(91,643 |

) |

|

$ |

(6,943 |

) |

|

|

|

|

|

||||

|

Net loss per share attributable to Amneal Pharmaceuticals, Inc.’s Class A common stockholders: |

|

|

|

||||

|

Basic and diluted |

$ |

(0.30 |

) |

|

$ |

(0.05 |

) |

|

Weighted-average common shares outstanding: |

|

|

|

||||

|

Basic and diluted |

|

307,279 |

|

|

|

152,109 |

|

Amneal Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets

(unaudited; $ in thousands)

|

|

March 31, 2024 |

|

December 31, 2023 |

|||

|

Assets |

|

|

|

|||

|

Current assets: |

|

|

|

|||

|

Cash and cash equivalents |

$ |

46,520 |

|

|

$ |

91,542 |

|

Restricted cash |

|

5,097 |

|

|

|

7,565 |

|

Trade accounts receivable, net |

|

668,955 |

|

|

|

613,732 |

|

Inventories |

|

570,653 |

|

|

|

581,384 |

|

Prepaid expenses and other current assets |

|

87,298 |

|

|

|

82,685 |

|

Related party receivables |

|

1,521 |

|

|

|

955 |

|

Total current assets |

|

1,380,044 |

|

|

|

1,377,863 |

|

Property, plant and equipment, net |

|

439,815 |

|

|

|

447,574 |

|

Goodwill |

|

598,549 |

|

|

|

598,629 |

|

Intangible assets, net |

|

859,272 |

|

|

|

890,423 |

|

Operating lease right-of-use assets |

|

32,970 |

|

|

|

30,329 |

|

Operating lease right-of-use assets – related party |

|

12,468 |

|

|

|

12,954 |

|

Financing lease right-of-use assets |

|

59,532 |

|

|

|

59,280 |

|

Other assets |

|

73,747 |

|

|

|

55,517 |

|

Total assets |

$ |

3,456,397 |

|

|

$ |

3,472,569 |

|

Liabilities and Stockholders’ (Deficiency) Equity |

|

|

|

|||

|

Current liabilities: |

|

|

|

|||

|

Accounts payable and accrued expenses |

$ |

558,518 |

|

|

$ |

534,662 |

|

Current portion of liabilities for legal matters |

|

30,130 |

|

|

|

76,988 |

|

Revolving credit facility |

|

179,000 |

|

|

|

179,000 |

|

Current portion of long-term debt, net |

|

33,660 |

|

|

|

34,125 |

|

Current portion of operating lease liabilities |

|

9,508 |

|

|

|

9,207 |

|

Current portion of operating lease liabilities – related party |

|

3,192 |

|

|

|

2,825 |

|

Current portion of financing lease liabilities |

|

3,305 |

|

|

|

2,467 |

|

Related party payables – short term |

|

17,075 |

|

|

|

7,321 |

|

Total current liabilities |

|

834,388 |

|

|

|

846,595 |

|

Long-term debt, net |

|

2,377,707 |

|

|

|

2,386,004 |

|

Note payable – related party |

|

41,893 |

|

|

|

41,447 |

|

Operating lease liabilities |

|

26,786 |

|

|

|

24,095 |

|

Operating lease liabilities – related party |

|

11,969 |

|

|

|

12,787 |

|

Financing lease liabilities |

|

58,809 |

|

|

|

58,566 |

|

Related party payables – long term |

|

11,394 |

|

|

|

11,776 |

|

Liabilities for legal matters – long term |

|

85,479 |

|

|

|

316 |

|

Other long-term liabilities |

|

24,579 |

|

|

|

29,679 |

|

Total long-term liabilities |

|

2,638,616 |

|

|

|

2,564,670 |

|

Redeemable non-controlling interests |

|

47,022 |

|

|

|

41,293 |

|

Total stockholders’ (deficiency) equity |

|

(63,629 |

) |

|

|

20,011 |

|

Total liabilities and stockholders’ (deficiency) equity |

$ |

3,456,397 |

|

|

$ |

3,472,569 |

Amneal Pharmaceuticals, Inc.

Consolidated Statements of Cash Flows

(unaudited; $ in thousands)

|

|

Three Months Ended March 31, |

||||||

|

|

|

2024 |

|

|

|

2023 |

|

|

Cash flows from operating activities: |

|

|

|

||||

|

Net loss |

$ |

(81,678 |

) |

|

$ |

(10,094 |

) |

|

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

||||

|

Depreciation and amortization |

|

55,528 |

|

|

|

58,150 |

|

|

Unrealized foreign currency loss (gain) |

|

1,511 |

|

|

|

(1,987 |

) |

|

Amortization of debt issuance costs and discount |

|

288 |

|

|

|

2,058 |

|

|

Intangible asset impairment charges |

|

920 |

|

|

|

— |

|

|

Change in fair value of contingent consideration |

|

100 |

|

|

|

2,457 |

|

|

Stock-based compensation |

|

6,722 |

|

|

|

7,596 |

|

|

Inventory provision |

|

22,923 |

|

|

|

25,204 |

|

|

Other operating charges and credits, net |

|

1,250 |

|

|

|

2,047 |

|

|

Changes in assets and liabilities: |

|

|

|

||||

|

Trade accounts receivable, net |

|

(55,173 |

) |

|

|

195,970 |

|

|

Inventories |

|

(12,200 |

) |

|

|

(22,508 |

) |

|

Prepaid expenses, other current assets and other assets |

|

(11,708 |

) |

|

|

29,160 |

|

|

Related party receivables |

|

(562 |

) |

|

|

470 |

|

|

Accounts payable, accrued expenses and other liabilities |

|

62,174 |

|

|

|

(150,483 |

) |

|

Related party payables |

|

5,495 |

|

|

|

1,672 |

|

|

Net cash (used in) provided by operating activities |

|

(4,410 |

) |

|

|

139,712 |

|

|

Cash flows from investing activities: |

|

|

|

||||

|

Purchases of property, plant and equipment |

|

(9,198 |

) |

|

|

(9,688 |

) |

|

Acquisition of intangible assets |

|

(9,700 |

) |

|

|

(338 |

) |

|

Deposits for future acquisition of property, plant and equipment |

|

(862 |

) |

|

|

(1,711 |

) |

|

Net cash used in investing activities |

|

(19,760 |

) |

|

|

(11,737 |

) |

|

Cash flows from financing activities: |

|

|

|

||||

|

Payments of principal on debt, revolving credit facilities, financing leases and other |

|

(63,377 |

) |

|

|

(72,659 |

) |

|

Borrowings on revolving credit facilities |

|

48,000 |

|

|

|

80,000 |

|

|

Proceeds from exercise of stock options |

|

28 |

|

|

|

— |

|

|

Employee payroll tax withholding on restricted stock unit vesting |

|

(7,212 |

) |

|

|

(2,022 |

) |

|

Tax distributions to non-controlling interests |

|

(594 |

) |

|

|

(18,219 |

) |

|

Net cash used in financing activities |

|

(23,155 |

) |

|

|

(12,900 |

) |

|

Effect of foreign exchange rate on cash |

|

(165 |

) |

|

|

767 |

|

|

Net (decrease) increase in cash, cash equivalents, and restricted cash |

|

(47,490 |

) |

|

|

115,842 |

|

|

Cash, cash equivalents, and restricted cash – beginning of period |

|

99,107 |

|

|

|

35,227 |

|

|

Cash, cash equivalents, and restricted cash – end of period |

$ |

51,617 |

|

|

$ |

151,069 |

|

|

Cash and cash equivalents – end of period |

$ |

46,520 |

|

|

$ |

144,674 |

|

|

Restricted cash – end of period |

|

5,097 |

|

|

|

6,395 |

|

|

Cash, cash equivalents, and restricted cash – end of period |

$ |

51,617 |

|

|

$ |

151,069 |

|

Amneal Pharmaceuticals, Inc.

Non-GAAP Reconciliations

(unaudited, $ in thousands)

Reconciliation of Net Loss to EBITDA and Adjusted EBITDA

|

|

Three Months Ended March 31, |

||||||

|

|

|

2024 |

|

|

|

2023 |

|

|

Net loss |

$ |

(81,678 |

) |

|

$ |

(10,094 |

) |

|

Adjusted to add: |

|

|

|

||||

|

Interest expense, net |

|

65,703 |

|

|

|

49,315 |

|

|

Provision for income taxes |

|

6,156 |

|

|

|

668 |

|

|

Depreciation and amortization |

|

55,528 |

|

|

|

58,150 |

|

|

EBITDA (Non-GAAP) |

$ |

45,709 |

|

|

$ |

98,039 |

|

|

Adjusted to add (deduct): |

|

|

|

||||

|

Stock-based compensation expense |

|

6,506 |

|

|

|

7,596 |

|

|

Acquisition, site closure, and idle facility expenses (1) |

|

444 |

|

|

|

2,701 |

|

|

Restructuring and other charges |

|

1,470 |

|

|

|

411 |

|

|

Charges related to legal matters, net (2) |

|

94,359 |

|

|

|

4,064 |

|

|

Asset impairment charges |

|

1,015 |

|

|

|

733 |

|

|

Foreign exchange loss (gain) |

|

1,197 |

|

|

|

(1,901 |

) |

|

Change in fair value of contingent consideration |

|

100 |

|

|

|

2,457 |

|

|

Increase in tax receivable agreement liability |

|

1,948 |

|

|

|

826 |

|

|

System implementation expense (3) |

|

917 |

|

|

|

771 |

|

|

Other |

|

(1,314 |

) |

|

|

483 |

|

|

Adjusted EBITDA (Non-GAAP) |

$ |

152,351 |

|

|

$ |

116,180 |

|

Contacts

Anthony DiMeo

VP, Investor Relations & Media

anthony.dimeo@amneal.com